Tens of millions of Americans who carry Chase credit cards in their wallets have been notified in recent weeks of a big change to the terms of their accounts with card issuer JPMorgan Chase Bank.

That change is a “binding arbitration provision” that essential means that cardholders no longer have the option of suing JPMorgan Chase or joining a class-action lawsuit if anything were to go wrong. Instead, any grievances would go before an arbitrator.

What does this arbitration provision from Chase mean, and how do I opt out?

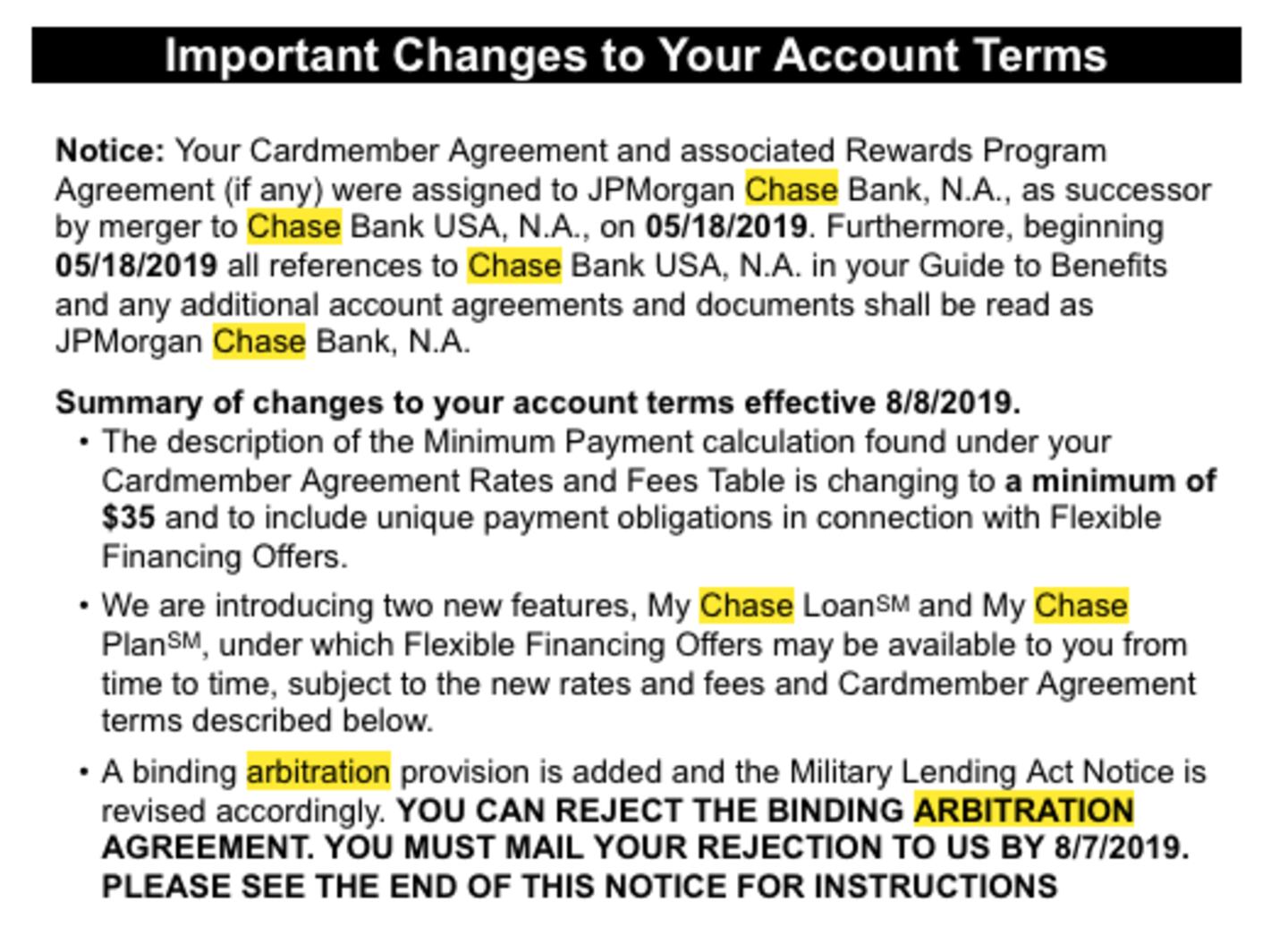

First of all, here’s what the email notice looked like. If you’re a Chase cardholder, you might want to check your inbox again if you missed it:

Money expert Clark Howard says that Chase actually has trailed most of the rest of of the financial industry in taking away legal access that you have if your bank or other financial organization has cheated you.

“They’re kind of a laggard on this, where they’ve continued to allow people to use their constitutional rights to go after the financial institution if they do something rotten or criminal or illegal like in the case of Wells Fargo,” Clark says.

“Now, unless you tell Chase otherwise, they’re going to take away your right under the U.S. Constitution to access the U.S. court system or state court systems.”

“The whole idea is they’re just taking advantage of the idea that the Supreme Court ruled 5 to 4 that financial institutions are free to impose these arbitrations on consumers,” Clark says.

"The horrible thing is the banks choose the arbitrators and they win just a hair under 100% of the time in these arbitrations because the arbitrators only keep working if they find for the banks. It's a terrible, terrible system."

But, as a cardholder, you do have an option: You can send Chase a letter (like the old days) to preserve your right to have access to the courts.

“The reality — and Chase knows this — is that nobody is going to do that, except maybe a few hundred or a few thousand people, even thought they’re such a huge financial organization,” Clark says.

Here is an example of what the letter should look like, courtesy of Military Money Manual:

Chase Customer Service

P.O. Box 15298

Wilmington, DE 19850-5298

Your First name Last name

Street address

City, State, Zip code

Regarding: Rejecting Chase Binding Arbitration Agreement

To Whom It May Concern:

Please note that I REJECT the Chase Binding Arbitration Agreement effective August 11, 2019. Please confirm receipt of this rejection and annotate my account(s) appropriately.

Name: First name Last name

Account Number(s): 4147-2222-3333-4444, 1234-5678-9012-2342

Billing Address: 124 Address Street, City, State ZIPCODE

Signature: (Actually sign here)

Thank you for your attention to this matter,

First name Last name

If you have questions about this or any other consumer-related issue, call our Consumer Action Center at 404-892-8227. It’s FREE and open Monday-Thursday 10am-7pm ET and Friday 10am-4pm ET!

The post Big change coming to Chase credit cards: Should you opt out? appeared first on Clark Howard.

Clark.com