Due to a recent policy change, Amazon will now let you use money from your flexible-spending account (FSA) or health-savings account (HSA) to pay for eligible products.

RELATED: Medi-Share & other health care sharing ministries: What you need to know before signing up

Amazon begins accepting FSA/HSA cards

The e-commerce giant recently begin allowing customers to use pre-tax money that they set aside from every paycheck to pay for eligible health care items.

Here’s how you can take advantage of this:

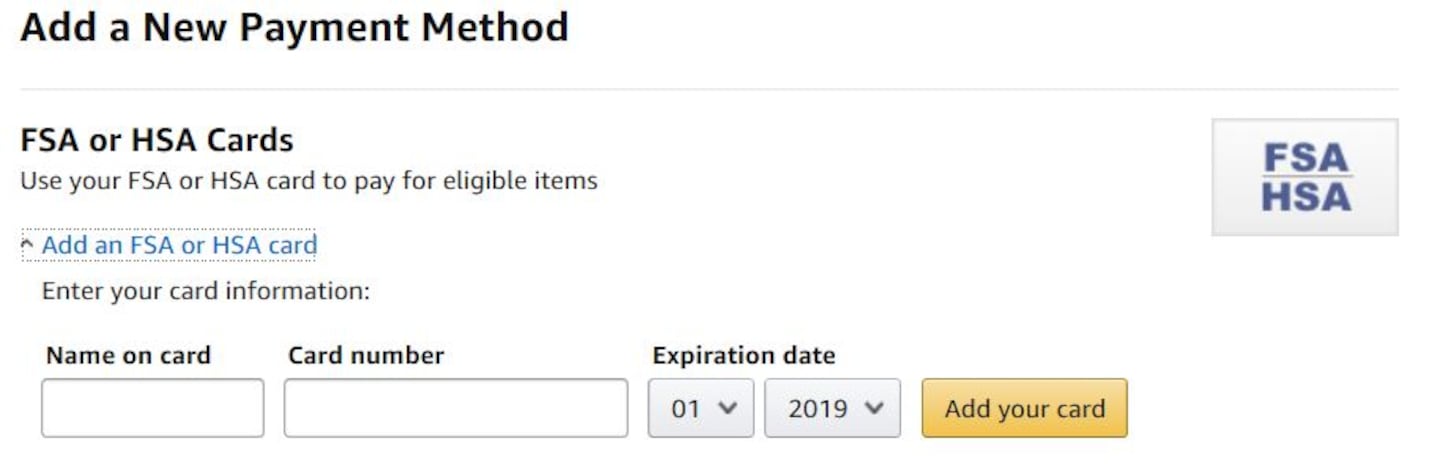

1. Add your FSA or HSA card as a payment option to your Amazon account. Click here to get started.

2. Log on to the Amazon.com FSA and HSA store when you're ready to shop.

3. Know which products are eligible for you to use your money on. Here is a very small sampling of the items you can buy:

- Auto Injectors, Pens, Kits and Needles

- Blood Glucose Testing

- Cholesterol Meters and Testing Kits

- Diabetes Care Accessories

- Grooming and Dressing Aids

- Hydrocolloid/Hydrogel Dressings

- IPPB, CPAP, BiPAP Machines and Accessories

- Medical Alert IDs and Devices

- Prenatal Vitamins

- Thermometers, Fever Strips and Accessories

- Ultrasound Devices

You can see a complete alphabetized list of eligible items here.

One restriction to note: You can’t use your FSA or HSA money to buy over-the-counter (OTC) medications.

"OTC medicines require a prescription to be FSA or HSA eligible, and this feature is not supported by Amazon," the company says. "However, you can still purchase these items on Amazon using other payment methods and request reimbursement from your plan administrator."

Clark’s take on FSAs

Clark Howard has long been a fan of FSAs.

With an FSA, you have money deducted from each paycheck that goes into a savings account. The money that's deducted is never taxed.

"Unfortunately, only one in five people who are eligible to do an FSA through their employer actually do it," the consumer expert says. "But more people should, because you get to pay for medical expenses with pre-tax dollars instead of post-tax dollars."

Remember these 2019 limits for FSAs and HSAs

| Flexible-spending account | $2,700 |

| Health-savings account | $3,500 (individual)/$7,000 (family) |

“Having the ability to divert money tax-free is really powerful. And the higher your income, the more doing an FSA makes a great deal of sense for you.”

More health stories on Clark.com

- 9 things to know before you use GoodRx

- Pill splitting: How I save 75% on prescription drugs

- Is Amazon Prime worth it?

The post You can now use your FSA or HSA money to shop on Amazon appeared first on Clark Howard.

Clark.com