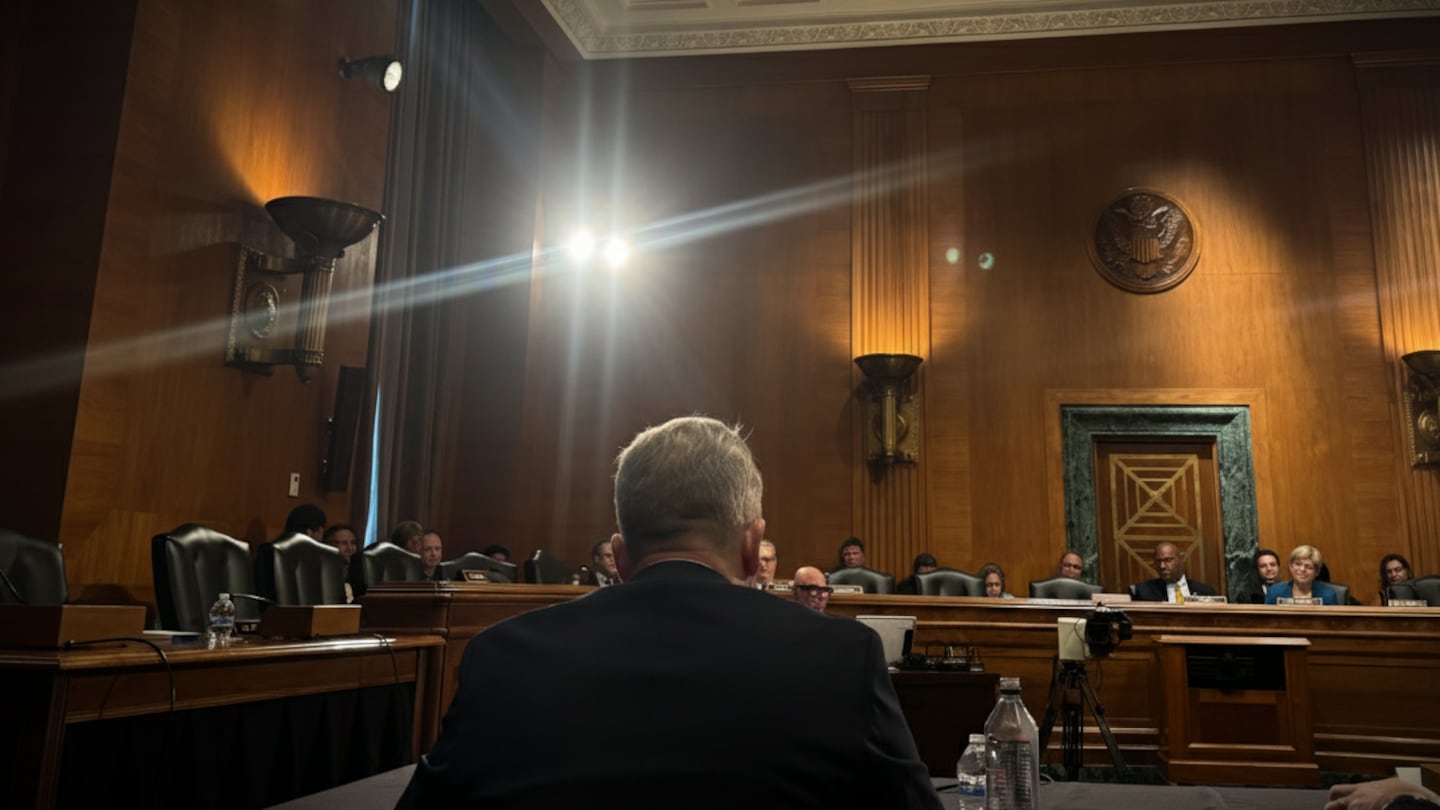

During the Senate Banking, Housing, and Urban Affairs Committee hearing on Wednesday, Hanscom Federal Credit Union’s President and CEO Peter Rice spoke on behalf of all credit unions across the country and overseas.

“This is bigger than banking,” he said. “This is about paychecks, communities, and the strength of our nation.”

Rice emphasized the importance of strengthening deposit protections and expanding credit union lending capacity.

“So far the only message we have sent to Main Street has been clear: if you’re big, you’re safe; if you’re local, you’re at risk,” he said.

Rice testified that protections for the largest banks in the nation would create dangerous ripple effects that would cripple local financial institutions, impacting small businesses everywhere and even undermining national security.

The Hanscom FCU CEO reminded the panel two-thirds of small businesses depend on local and regional lenders.

He also outlined six targeted reforms for Congress to protect communities, payrolls, and supply chains without encouraging recklessness.

“The challenge is balancing stability with avoiding moral hazard,” Rice said. “Blanket guarantees calm panic but encourages reckless behavior.”

This is a developing story. Check back for updates as more information becomes available.

Download the FREE Boston 25 News app for breaking news alerts.

Follow Boston 25 News on Facebook and Twitter. | Watch Boston 25 News NOW

©2025 Cox Media Group